In today's financial landscape, where credit scores wield significant influence over our ability to secure loans, mortgages, and even job opportunities, the importance of maintaining a healthy credit file cannot be overstated. However, for many individuals, credit history can feel like a double-edged sword. Past mistakes, unforeseen hardships, or simply the weight of time can lead to a credit file that holds them back from achieving their financial aspirations. But what if there was a way to start anew, to unlock a world of possibilities with a fresh legal credit file?

Obtaining a new credit file may seem like an unconventional approach, but it can offer surprising advantages. Not only does it provide a clean slate, but it also enables individuals to reestablish their financial reputation and regain control over their financial future. From improved loan eligibility to access to better interest rates, a new credit file can be the key to navigating the often complicated realm of credit. As we explore these benefits, it's essential to understand how this fresh start can empower individuals to seize new opportunities and transform their financial journey for the better.

Understanding a Fresh Legal Credit File

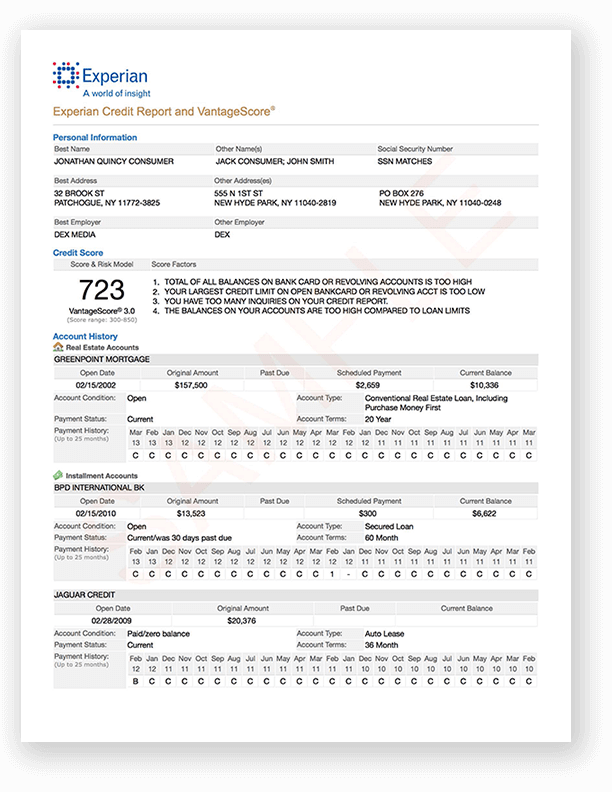

A fresh legal credit file is essentially a newly established credit history that individuals can create by certain legal means or by utilizing specific services. This can involve legitimate practices such as credit repair, identity protection services, or by establishing a new line of credit. A clean slate allows consumers to navigate their financial future without the burdens associated with past financial mistakes or negative reports.

Having a new credit file offers individuals an opportunity to build a positive credit history from scratch. With no previous entries to affect their credit score, borrowers can manage their finances better and establish responsible credit habits. This renewed start is especially beneficial for those who have struggled with debts or poor credit ratings, enabling them to access credit products that they may have previously been denied.

Furthermore, a fresh legal credit file can open doors to new financial opportunities. With an improved credit score, individuals may qualify for loans, credit cards, and mortgages at more favorable terms. Lenders are often more willing to extend credit to individuals who show a responsible repayment pattern on their new accounts, ultimately enhancing their financial stability and growth potential.

Benefits of Having a New Credit File

Creating a new credit file can provide individuals with a clean slate to build a positive credit history. When someone has faced financial difficulties in the past, their credit report may contain negative information that can hinder their ability to secure loans or favorable interest rates. By starting fresh, individuals have the opportunity to establish a strong payment history, demonstrating their reliability to lenders and improving their chances for future credit approvals.

A new credit file allows individuals to take advantage of better credit options that may have been previously unavailable to them. With a clean history, they can potentially qualify for credit cards with lower interest rates, higher credit limits, and rewards programs. This can lead to not only increased purchasing power but also a more advantageous position when negotiating for loans or other financial products.

Additionally, having a new credit file can empower individuals to manage their finances more effectively. With a fresh start, they can focus on responsible financial habits and budgeting, leading to improved overall financial health. This renewed effort to maintain a positive credit profile can pave the way for greater financial freedom and stability, opening doors to new opportunities such as homeownership, car financing, and business loans.

Steps to Create and Manage Your New Credit File

Creating a new legal credit file involves several key steps that can help you establish a solid financial foundation. Begin by obtaining a new individual taxpayer identification number or Social Security number if you are eligible. This new identification is critical to ensure that your new credit file is separate from any previous records. After securing your identification, open a new bank account to start fresh and establish a positive banking relationship.

Next, apply for a secured credit card or a credit-builder loan, which helps you to generate positive credit activity. Make small purchases on your credit card and ensure you pay them off in full each month. This strategy not only builds your credit score but also demonstrates your responsible borrowing habits to future lenders. Regularly reviewing your statements and adhering to payment schedules is essential to maintaining a healthy credit profile.

Finally, monitor your new credit file diligently. Access your credit report periodically to check for inaccuracies or signs of fraud. This proactive approach helps protect your credit standing and allows you to identify areas for improvement. By being mindful of your financial actions and maintaining good credit habits, you will unlock new opportunities that come with a strong legal credit file.